Table of Contents

What Is Stock Market?

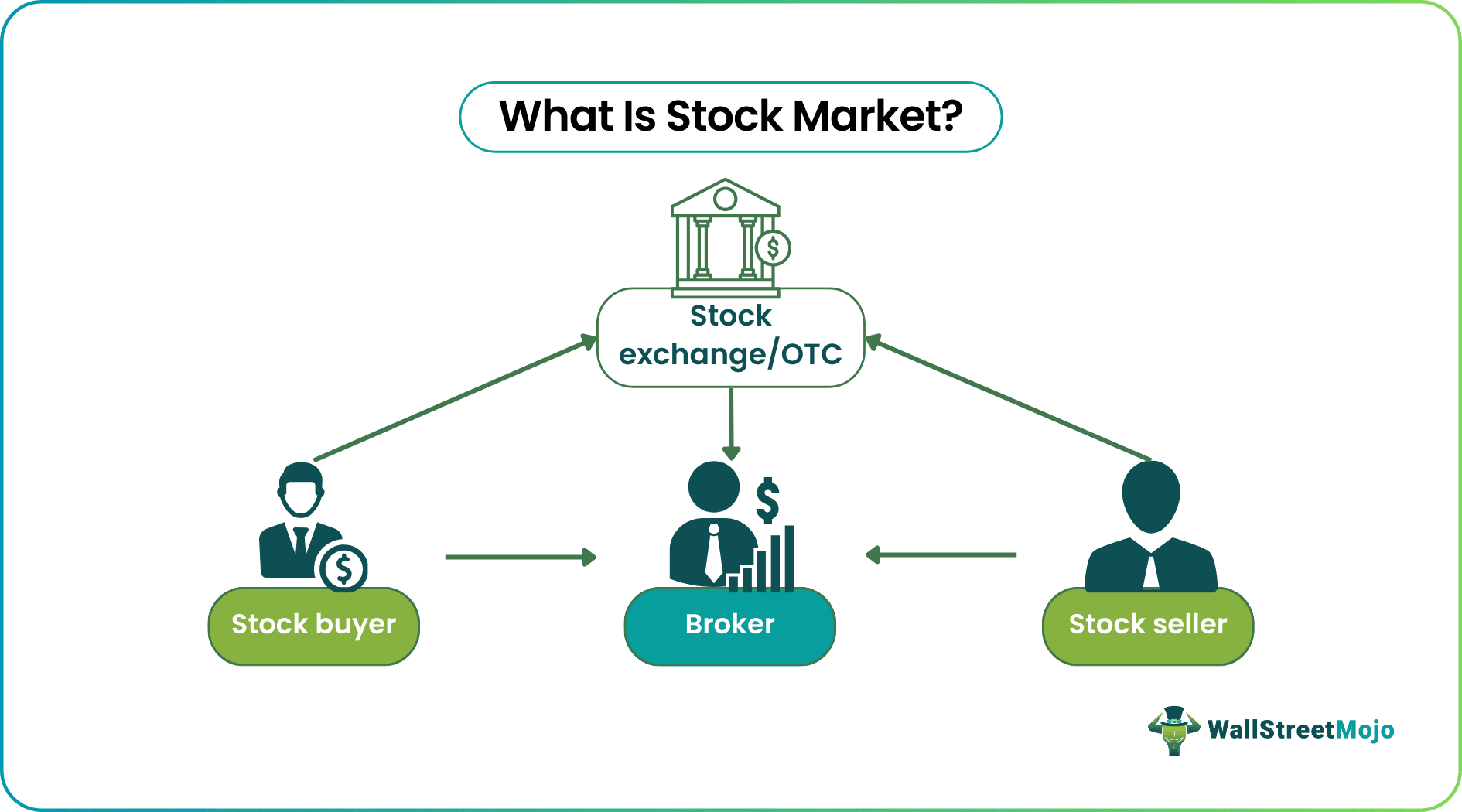

A stock market is a platform for buying and selling shares or stocks. The interested stock buyers and sellers connect, find suitable deals, and book the same. It is a marketplace where the people interested in buying and selling a company's stocks connect directly or through brokers.

The market operates via over-the-counter (OTC) or stock exchanges that list the stocks of the companies issuing shares for trade. Some widely preferred exchanges include New York Stock Exchange (NYSE), NASDAQ, National Stock Exchange (NSE), etc. Here, investors can opt for both short-term and long-term investments.

- The stock market works on the basic principle of matching supply and demand through an auction process where investors are willing to pay a certain amount for an asset and sell off something they have at a certain price.

- Each asset has a value with individual preference and price facilitating the ultimate asset valuation as the market determines.

- The market works like an anonymous auctioning machine – one person auctions assets and waits for another person to bid the right amount.

- The stock market encourages active investments rather than passive ones.

Stock Market Basics Explained

A stock market definition is similar to a market for buying and selling goods and services. It is a marketplace where financial instruments are bought and sold in exchange for money. The trade helps companies raise funds to develop and grow their business, making investors earn profits when the firms perform well and incur losses when they do not perform per expectations.

The emergence of this market can be traced back to the 1600s when the Dutch East India Company sent multiple ships on voyages to trade gold, porcelain, spices, silk, etc., around the world. However, these voyages were quite expensive. Thus, the traders approached citizens to fund the transportation in exchange for a portion of the profits.

Given the income generated by funding the trips, the individuals invested in the voyages. The process helped businesses fund grand voyages, thereby increasing profit-making scopes. This sale of shares made the Dutch East India Company the originator of the stock market investing idea.

In this market, the brokers facilitate trading or investing by acting as intermediaries between the exchange and the trader. There are also portfolio managers who keep track of stock market news and who are very efficient in managing funds that are invested in a wide variety of securities. They invest the funds in such a way so that there is maximum return with minimum risk. There are also investment bankers who guide corporates regarding IPOs or acquisitions.

The exchange or stock market allows the maximum participation of individuals and corporations, which is the best way to mobilize financial resources within the economy, which will lead to increase in demand, savings and investment for overall growth and expansion of the country.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Process

With time, the companies aiming to raise funds to grow their business listed themselves on a stock exchange to make their share available to be bought and sold. They introduce their stocks for investments, and the investors spent on them, sponsoring the company's initial public offering (IPO), which finally made the stocks of the company public.

The buyers keep track of stock market news, who find the stocks profitable can purchase them in lots. The lot size is the number of stocks offered for sale or asked for at a certain price. If the stock value rises in the long run as expected, given the company's improved performance, the investors reap profits. On the other hand, if the stock value decreases because of the poor performance of the business, the buyers have to sell the stocks at a lower rate to hedge risks. The investors may also receive profits through dividend payments.

The market, however, does not always go up. There have been multiple instances of a stock market crash, which has been triggered by a sudden steep drop in stock prices within a specific day. The crashes are normally caused by natural disasters, speculations, and investor panic arising from rumors.

The market remains open throughout the year from Monday to Friday from 9:30 a.m. to 4:00 p.m. eastern time except for the yearly trading holidays and decided half-days. The U.S. Securities and Exchange Commission (SEC) regulates and monitors the stocks on the exchanges.

Functions

The stock market in any country has a number of important roles or functions to perform, which are detailed below:

- The main function of the market is facilitating trading or investment on stocks and other securities in a fair and transparent manner. It is well regulated to keep track of every movement in terms of investor behavior as well as stock prices and performances.

- Stock market investing helps in maintaining transparency in prices and trading process, through availability of accurate data as and when needed, which will ensure every participant within the market gets a fair chance to play their role.

- It ensures the discovery of fair prices through information availability. Due to a well developed and maintained software system, which is monitored continuously, investors are able to pick the exact stock and price they want at the exact time and trade in it. This instant access also ensures that orders placed are also executed at the correct price.

- Market participant may be for long term or short term. Investors for long term plan to put their money and stay in the market for many months of years. Through fair dealing process followed within the market, except in special instances of stock market crash, these long term investors are able to get the required return as anticipated, Even for short term traders, who put money to get instant return within a few days or weeks, the market has a strongly designed system that ensures the entry and exit can be made instantly, within seconds, because any delay will alter the data and result in incorrect transaction value.

- The market has mechanisms to trade in various forms of securities, each of which can also be used to create financial instruments that will not only provide return, but also provide liquidity to the market through minimization of risk.

Thus, the global stock market stock market has a very crucial role in the economic system of a nation and every citizen has the responsibility to abide by all required rules and regulations so as to use it in an ethical manner.

Factors

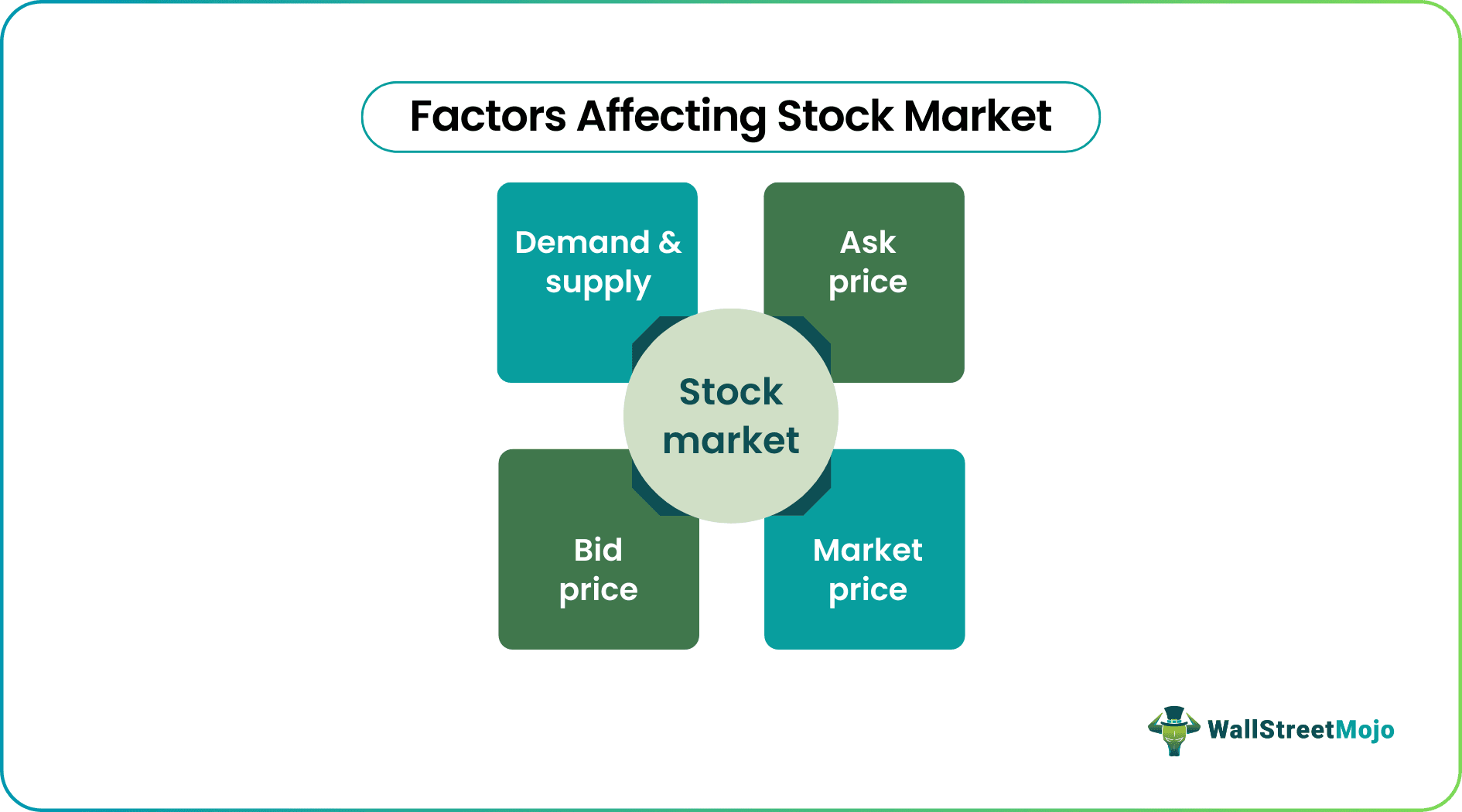

A stock market works on multiple parameters that determine the sale, purchase, pricing, and fluctuations occurring in the market.

1. Demand & Supply

It uses demand and supply as the driving force. As good as this is, other derivatives depend on stocks, and people can change the supply to move the option prices in the direction they want. The anonymity makes it tough to trace back to the owner.

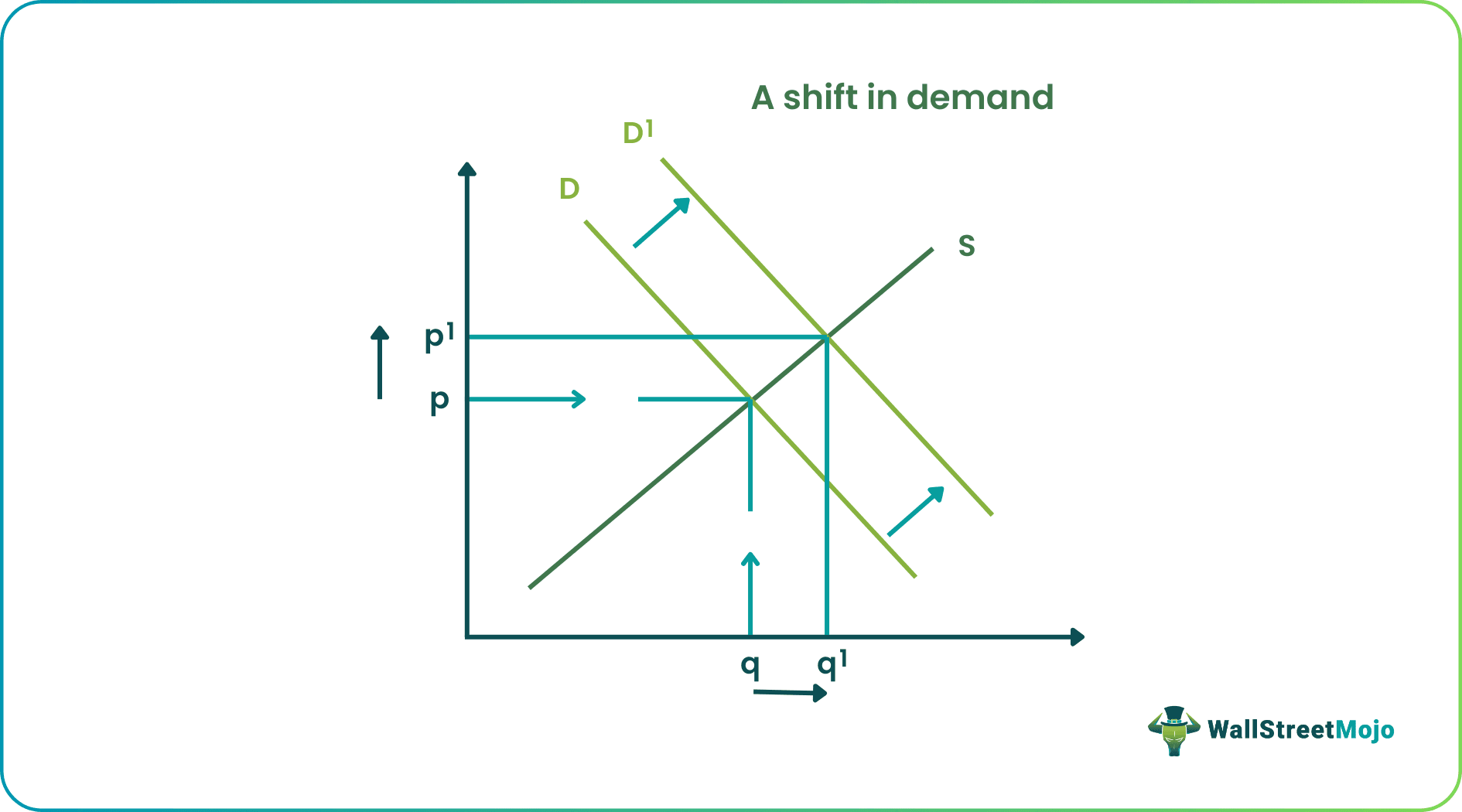

The line 'D' is the demand, and 'S' supplies, with a horizontal axis being the quantity (q) and the vertical axis (p) being the price. Here, as price increases, supply increases, and demand decreases. The point of the stock market is to find a midpoint and proceed with the transaction.

2. Pricing

The price labels in case of stock market investing associated with a company's stocks differ – market price, bid price, and ask price.

The market price is the current value of the stocks. It could be of two types – opening price and closing price. While the former is the market price at which stock opens at the beginning of the day, the latter is the last price at which the stock was traded on the previous working day.

When multiple buyers want to buy a stock, they bid for it, and the highest price becomes the bid price. On the other hand, when multiple sellers start selling the stock, they ask for a specific price. The lowest of such prices is the ask price. The transaction occurs when the highest bid and the lowest ask prices meet. To see how this works in real life, you can monitor a specific stock such as the Telstra share price. Watch how the price changes when it opens at the start of the day and when it closes at the end of the day, and observe how these movements vary over weeks, months, and years.

How To Invest?

Investors who plan to invest in the stock market, either the primary (IPO) or the secondary market, should first of all open a Demat Account. A demat account is very similar of a bank account, where all shares certificates or any other forms of securities will be stored in electronic or dematerialized form.

The securities may include bonds, mutual funds, exchange traded funds (ETFs), insurance and so on. This demat account is compulsory for investment on stocks and is very useful because it reduces the hassle of storing stocks and other securities in paper form or physical form, which often leads to misplacement. Along with the demat account, the investor will also have to open a trading account, which will facilitate buying and selling of shares.

In the primary market, where the investors subscribe to shares issued by a company for the first time, the allotment will be limited, because it will depend on the availability of shares as well as its demand in the market. However, this process can be done online. Once the shares are allotted, the investor can trade in them using the demat account once again, in the secondary market.

Since now the shares are stored safely in the demat account, the investor will use the trading account to select which share to buy or sell, decide its price as per their analysis by studying the company details and market condition in general, through technical charts and annual report and finally place order for the transaction.

It is to be noted, that for every buyer in the global stock market, there should be a seller to complete the transaction, otherwise the trading cannot take place.

Example

Take an example of one of the most traded stocks ever – Apple on NASDAQ. NASDAQ is the exchange that deals with the stocks of the technology giants.

The current trade price for Apple (AAPL) is 204.23, but on June 3rd, it closed at 204.41 and opened at 203.35 the next day. On July 3rd, the stock's highest price was 204.44, and the lowest was 202.69 – one should consider that these are the traded highs and lows, not the ask and bid highs and lows.

These details are taken from Ameritrade as the broker, and the bid and ask spreads are as follows for a certain point on July 3rd.

| Bid Price | Bid Size | Ask Price | Ask Size |

| 203.83 | 180 | 203.97 | 80 |

| 203.85 | 1160 | 204 | 945 |

| 203.86 | 160 | 204.02 | 30 |

| 203.89 | 100 | 204.05 | 110 |

| 203.9 | 860 | 204.06 | 92 |

Observation

In the above table, 203.84, 203.87, and 203.88 USD are unavailable; no one has specifically bid at that price. Therefore, the bid sizes are the number of stocks asked for at that price. The same is the case with the asking price. If the 203.90 (highest bid price) and 203.97 (lowest ask price) match, the stock market executes the transaction, and the lot sizes are deleted.

So, if the demand is more, the bid prices go up, and as the transactions are conducted, the prices rise, and the transaction occurs at the highest available rate.

The difference between the highest bid and lowest ask prices is called the bid-ask spread, which helps gauge the stock’s liquidity. Since Apple has highly traded stocks, such situations where the bid and ask are about six ticks (each tick in the USA is 0.01USD) are rare.

Stock Market Vs Cryptocurrency Vs Real Estate

| Category | Stock Market | Cryptocurrency | Real Estate |

| Asset | Stocks (collection of shares) | Cryptocurrency | Property |

| Value | Equity-based | Subjective valuation | Market-based valuation |

| Options | Diversification allowed | Diversity of trade is less likely | No diversification allowed |

| Volatility | Frequently impacted by events and stock market news | Greater volatility | Volatile |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.